las vegas mortgage guide for smart homebuyers

What makes financing here unique

In a city built on momentum, a las vegas mortgage rewards preparation. Lenders weigh income stability across hospitality, tech, and small businesses, so clean documentation and early pre-approval help you move the second a home hits the market. Seasonal shifts, HOA rules, and condo warrantability can also shape terms, rates, and timelines.

Popular loan paths and benefits

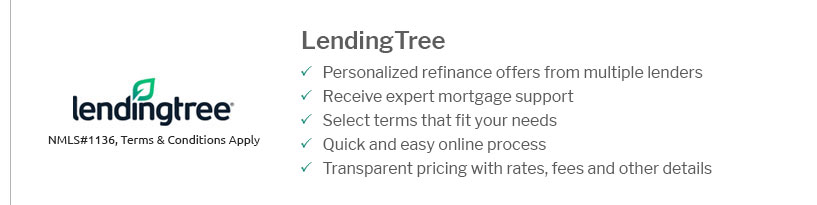

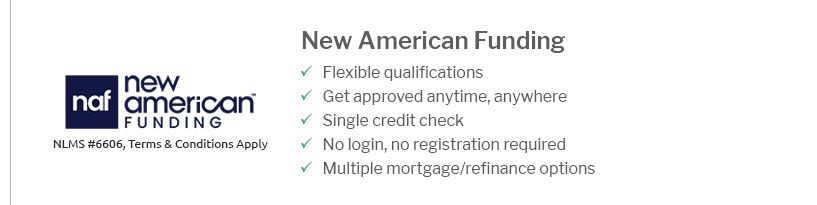

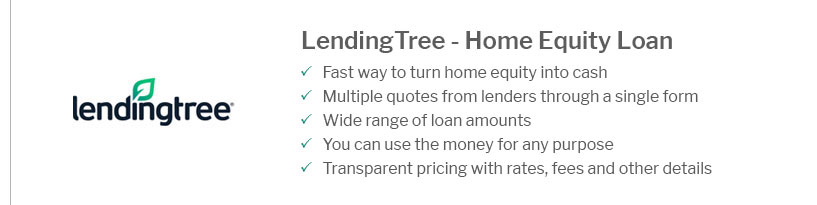

From conventional and FHA to jumbo and VA, choices hinge on credit, down payment, and property type. Buyers often pair seller credits with rate buydowns to manage payments, or refinance later if equity grows. Transparent estimates, taxes, insurance, and HOA dues keep the true monthly picture clear.

- First-time purchase for a condo near transit or the Arts District

- Move-up home in Summerlin or Henderson with room to grow

- Investment property targeting long-term, compliant rentals

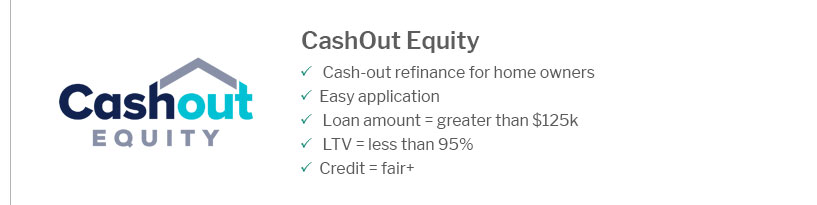

- Cash-out refinance to consolidate higher-interest debt

- VA options for eligible service members and veterans

Next steps: compare quotes, verify fees, lock strategically, and coordinate appraisal and HOA docs early to close smoothly.